Administrative Procedures

Student Organization Authorization and Compliance

Procedure Number: 5.7.11-P

Current Effective Date: 03/15/2023

Original Effective Date: 07/01/2012

Revision Dates: 11/01/2013, 03/15/2023

Revision Number: 2

Revision Summary: correct broken links

Responsible Official: Vice President, Administrative Services

References: Supersedes Procedure 7.11 and 7.12 dated July 1, 2010

Sections:

- Section 7.11.1 – Student Organizations - General

- Section 7.11.2 – Student Organizations Defined

- Section 7.11.3 – All Student Organizations

- Section 7.11.4 – Student Organizations Handling and Raising Monies

- Section 7.11.5 – Operating Principles for Actual Handling of Monies

- Section 7.11.6 – Organizations Created for Student Scholarships and Loans

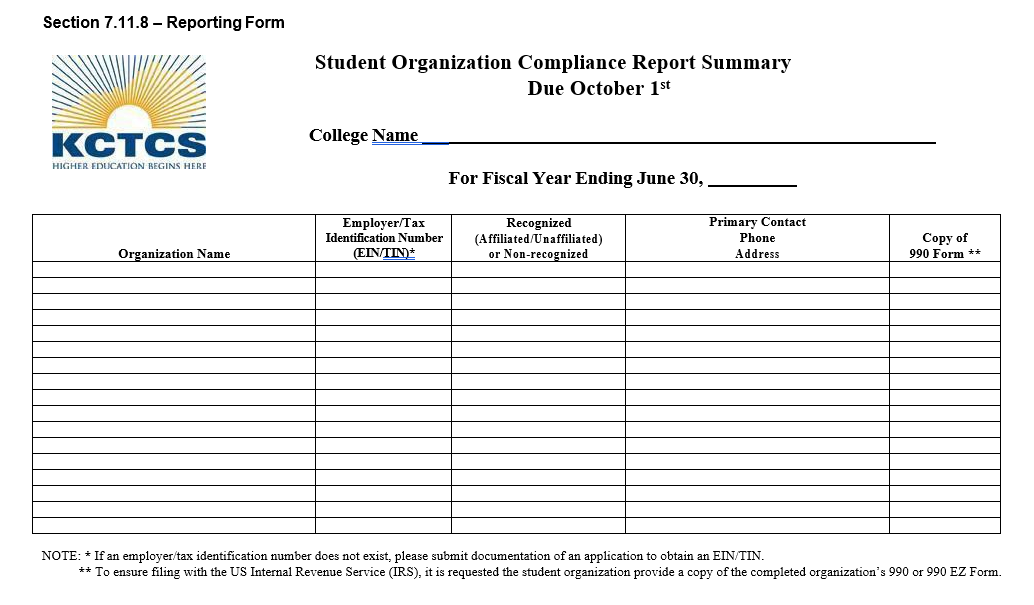

- Section 7.11.7 – Compliance Exhibit A – Reporting Form

Section 7.11.1 – Student Organizations – General

All student organizations, regardless of type, are expected to comply with applicable federal and state laws and with KCTCS policies and procedures. Student organizations are not permitted to use KCTCS’ EIN/TIN for any purpose. Student organizations with a bank account number must have their own EIN/TIN. For information regarding how to file for an EIN/TIN please consult the IRS for Form IRS SS-4 IRS EIN / Tax ID Number (2023) (federal-taxid-number.com)

Filing federal or state tax returns for the organization and complying with related federal and state law is the responsibility of the student organization.

The Pension Protection Act of 2006 mandates that most tax-exempt organizations must file an annual tax return or submit an electronic notice with the IRS. The Act states that any tax exempt organization that fails to file the required documents for 3 consecutive years is subject to loss of its federal tax-exempt status. (Exempt Organizations-Required Filings) Typically, student organizations will fall under the United States Internal Revenue Service (IRS) tax code section 501(a) for social clubs and be eligible for tax exempt charitable giving if receipts are less than $5,000 annually. Consultation with professional legal and tax counsel are encouraged because even not-for-profit organizations (i.e., 501(c)3 and 501(a)) are required to file annual tax forms, regardless of any tax liability. The type of return required will depend on the amount of receipts of the organization. Note: the $5,000 threshold includes all forms of funds collected, i.e., activity fee money, donations, sale activities, dues collected from members, etc.

Typically, organizations with receipts below the $5,000 threshold can electronically submit IRS Form 990-N (often this is referred to as an e-postcard). An organization may choose to submit Form 990 or 990 EZ. The electronic form is due by the 15th of the 5th month after the close of the organization’s tax year. Example: the student organization’s calendar runs from July to June. The filing must occur by November 15th . All student organizations are strongly encouraged to contact the IRS Account Services Unit prior to filing electronically (877-829-5500) to request the IRS establish the organization’s account to accept electronic 990-N (e-postcard) filing.

Student organizations holding fund raising activities are also encouraged to contact the Kentucky Department of Revenue at 502-564-4581 because even though the organization may be exempt, various fundraising activities may be considered unrelated business income, especially where tangible goods are involved. (Online resources at KY Department of Revenue website.) Some student organizations may already be incorporated or apply for incorporation as a 501(c) 3 charitable organization. However, student organizations may apply for tax exempt status under section 501(a) even if they draw income or accept donations and section 501(a) is believed to be a better fit given the typical purpose of most student organizations. All student organizations raising funds are to operate on a not-for-profit basis and obtain an Employer Identification Number/Tax Identification Number (EIN/TIN). For tax exempt status under section 501(a) the student organization will need to complete IRS Form 1024. Check box “e” Section 501(c)(7) – Social clubs. Sections I, II, III and Schedule D must also be completed. Full instructions for Form 1024 are available here. Along with Form 1024, the student organization will need to complete Form 8718 and must include the required $400.00 filing fee. Complete instructions for filing for tax exempt status can be found on Publication 4573, Group Exemptions. For further assistance in in completing this process for Federal tax exemption, call 1‐877‐829‐ 5500. Send completed forms to: Internal Revenue Service P.O. Box 12192 Covington, KY 41012--‐0192 All student organizations that are involved in fundraising activities and/or have a bank account are required to register with the college’s office of student affairs and to file a student financial report with the college annually by the required date. Please refer to section 7.11.2 Student Organizations Defined, below for additional detail. Student organizations because of their operating as a not-for-profit organization under Kentucky Law are also required to register with the Kentucky Secretary of State’s Office.

Section 7.11.2 – Student Organizations Defined

Student organizations are defined by KCTCS Board of Regents Policy 6.1, “Code of Student Conduct, Article V” (Code of Student Conduct) and must comply with that policy to be recognized. Student organizations are further defined as affiliated, unaffiliated, and non-recognized for purposes of student organization finance and this business procedure.

- Affiliated student organizations are recognized by the college and generally represent 1) a chapter or unit of a recognized national or state organization, 2) the college in academic or athletic competitions, or 3) a course or program of study at the college. Organizations that wish to be recognized as affiliated must:

- Have two sponsors, with at least one being a full-time employee of the college

- Establish and maintain bylaws, rules, or a constitution that clearly defines the organization’s

formal name, purpose, founding sponsor’s names and addresses (if available), the principle

officer’s titles and who its members are, its governance structure, policies and processes

for dissolution, and whether the group will or will not be handling funds of any kind

- These documents will generally include:

- Name and purpose of the organization

- Name and address of principle officers

- Description of the activities of the organization that supports its tax exempt status (if tax exempt)

- Description of membership (i.e., how does one become a member)

- List of officers and description of how the officers are chosen, terms, etc.

- A provision for dissolution of the organization if it dissolves and what becomes of the organization’s assets

- These documents will generally include:

- Comply with KCTCS policies and procedures, including but not limited to Article V of the KCTCS Student Code of Conduct

- Apply as a registered student organization with the college (see the Code of Student

Conduct, Article V, 5.2) and be approved by the college president and chief executive

officer (CEO) or their designee.

Affiliated organizations may use the college’s name in their organizational name accompanied by the national association. Example the Ashland Community and Technical College (ACTC) Health Occupation Student Association (HOSA) Chapter or ACTC-HOSA Chapter. Permission to collect, accept, handle, or request funds of any kind is contingent on the sound record keeping and the submission of the required annual financial reports. - Unaffiliated student organizations are recognized by the college and must:

- Have two sponsors

- Establish and maintain bylaws, rules, or a constitution that clearly defines the organization’s formal name, purpose, founding sponsor’s names and addresses (if available), the principle officer’s titles and who its members are, its governance structure, policies and processes for dissolution, and whether the group will or will not be handling funds of any kind

- These documents will generally include:

- Name and purpose of the organization

- Name and address of principle officers

- Description of the activities of the organization that supports its tax exempt status (if tax exempt)

- Description of membership (i.e., how does one become a member)

- List of officers and description of how the officers are chosen, terms, etc.

- A provision for dissolution of the organization if it dissolves and what becomes of the organization’s assets

- Comply with KCTCS policies and procedures, including but not limited to Article V of the KCTS Student Code of Conduct

- Apply as a registered student organization with the college (see the Code of Student

Conduct, Article V, 5.2) and be approved by the college president and chief executive

officer (CEO) or designee.

Unaffiliated organizations shall not use, in full or part the college’s name or initials or the KCTCS name or initials in their organizational name. Permission to collect, accept, handle, or request funds of any kind is contingent on sound record keeping and submission of required annual financial reports. - Non-recognized organizations are defined as organizations falling outside the KCTCS Board of Regents Policy 6.1, “Code of Student Conduct, Article V.” Members of these organizations are generally composed of faculty, staff, students, or individuals in the community. Membership may include any combination of these persons. These organizations may not use the KCTCS name or initials, a KCTCS college name or initials, facilities, equipment, etc., or receive actual or implied support of KCTCS without express written approval from the college president/CEO as prescribed in KCTCS Business Procedures 2.4 Use of Facilities by Outside Agencies and 2.5 Off Site Use of Equipment by Employees and Administrative Policy 3.3.16 Kentucky Community and Technical College System Policy and Procedural Guidelines for Management and Use of Facilities. Non-recognized organizations who wish to have a presence on campus must register with the college (see the Code of Student Conduct, Article V, 5.2). The college CEO may also establish additional requirements for non – recognized organizations regarding organization finance as described in this procedure.

Section 7.11.3 – All Student Organizations

- Students who travel on organization related activities must provide the college’s

business office with a letter or statement of liability waiver in advance of the travel.

- Organizations using the facilities or equipment of KCTCS must comply with KCTCS Business Procedures 2.4 Use of Facilities by Outside Agencies and 2.5 Off Site Use of Equipment by Employees and Administrative Policy 3.3.16 Kentucky Community and Technical College System Policy and Procedural Guidelines for Management and Use of Facilities, and college procedures or practices.

Section 7.11.4 –Student Organizations Handling and Raising Monies

- The student organization must establish and maintain a bank account separate from

the college or KCTCS. The account should clearly reflect the fact that the funds are

for the use of the club or organization and not the college/KCTCS. Any expenditure

from the account of an affiliated student organization must be pre-authorized by one

college sponsor and one student officer. Any expenditure from the account of an unaffiliated

or non-recognized student organization must be pre-authorized by two officers of the

organization.

- Funding sources for student organizations may be from dues, sponsorships, donations,

or student fundraising activities. Student organizations may be eligible for college

sponsorship funding dependent upon affiliation and bona fide business purpose of request.

If college funding is provided, the requesting student organization must provide an

invoice to the college. Payment to the student organization shall be via a “CKR” voucher

with the invoice and supporting documentation attached. If not within the KCTCS vendor

data base, the student organization must complete a KCTCS substitute W-9 form, including

its banking information to allow electronic (ACH) payment.

- In order to avoid confusion on who (the college or a student organization) is soliciting

a donation/contribution all requests by student organizations for donations/contributions

must comply with KCTCS Business Procedure 3.14 Gifts for both the college institutional

advancement office and the KCTCS Office of Institutional Advancement.

- College funding, if any, shall be provided to affiliated student organizations via

a check request voucher processed through KCTCS PeopleSoft Financials with supporting

documentation attached. Purchases using KCTCS’ sales tax exemption are not to be made

on behalf of the student organization. The student organization can provide its banking

information with the completion of its KCTCS Substitute W-9 to facilitate an electronic

ACH (automated clearing house) payment versus a paper check. Ad hoc requests for support

of conferences, competitions, and other activities must be through the college’s approved

budget process.

- Each organization must obtain its own Tax Identification Number (TIN), Kentucky Sales

Tax Exemption certificate and register with the Kentucky Secretary of State’s Office

as a not-for-profit corporation. The KCTCS TIN and sales tax exemption cannot be used

by the student organization.

Note: Kentucky Revised Statue 139.495 speaks to application of sales tax for nonprofit organizations. The Kentucky Department of Revenue should be contacted as to whether the student organization qualifies for a sales tax exemption per Form 51A125 Purchase Exemption Certificate. The telephone number of the Kentucky Department of Revenue Division of Sales and Use Tax is 502-564-5170.

Section 7.11.5 – Operating Principles for Actual Handling of Monies

The following guidelines, which are consistent with Generally Accepted Accounting Principles (GAAP), are applicable for all student organizations, regardless of affiliation.

- Pre-numbered receipt books must be used to record monies collected. Receipts should

equal deposits made. If, and where, exceptions are made for individual receipts for

such fund raising activities like bake sales, car washes, etc., the student organization

is still responsible the accounting of the gross receipts of the activity as it relates

to potential tax reporting/liability.

- Dues deposited should equal dues paid by members listed on the membership list. A

separate list should be maintained for all nonpaying or delinquent members.

- All checks received should be restrictively endorsed “For Deposit Only” with the student

organization’s account bank and number and deposited timely.

- All checks written must have a matching invoice or receipt. The check number, date

paid and brief memo should be written on each check.

- All expenditures must have prior approval by the student organization and should be

noted in the organization’s meeting minutes.

- Bank statements are to be reconciled monthly and documentation maintained.

- A year-end financial report should be prepared and presented to the organization.

Section 7.11.6 – College Required Financial Reporting (All Student Organizations Handling Monies)

- Each affiliated and unaffiliated student organization must provide an annual report

of the financial activities of the organization to the college chief student affairs

officer by not later than October 1 st for the preceding year fiscal year beginning

July 1 st and ending June 30th . Included with the report submitted a copy of the

student organization’s’ bank statement for the month of June is to be included.

The college office of student affairs will in turn file a summary report to the KCTCS System Office of Business Services for all its student organizations by November 15th .

The report shall include the following information:- Name, account number, and address of bank.

- Names of individuals with signature authority -- KCTCS employees having signature authority must be noted as employees.

- Balance on hand at the beginning of the year.

- Receipts by source.

- Expenses by source.

- Balance on hand at the end of the fiscal year – June 30th .

- Copy of IRS Form 990 submitted for that reporting year.

- A listing by amount, source, and depository or location of any other assets or liabilities

of the organization.

- Please see Exhibit A below for example.

Section 7.11.6 – Organizations Created for Scholarships and Loans

Funds raised for scholarships or loans must be on deposit with KCTCS or one of its recognized college foundations. Please contact the college’s office of institutional advancement for assistance in establishing student scholarship or a student loan account. Note: scholarship and loan accounts, if housed within KCTCS, must me coded correctly within KCTCS’ chart of accounts, funds 11 and/or 40.

Section 7.11.7 – Compliance

Failure to comply with this procedure may result in possible sanctions being imposed on the organization by the college, the Commonwealth of Kentucky and/or federal agencies of the United States of America.