Administrative Procedures

Bank Reconciliations

Procedure Number: 5.3.4-P

Current Effective Date: 06/01/2018

Original Effective Date: 07/01/2009

Revision Dates: 07/01/2009, 07/01/2013, 09/01/2017

Revision Number: 3

Revision Summary:

Responsible Official: System Director of Treasury Management

References:

1. Purpose

To provide guidance on KCTCS bank reconciliations.

2. Scope

This procedure applies to all colleges and the system office.

3. General

3.1

A bank reconciliation must be completed every month for each bank account that the college controls and for system office accounts.

- The bank reconciliation must be transmitted to KCTCS Office of General Accounting Services email account so-accounting@kctcs.edu by the 20th day of the following month (e.g. October reconciliation transmitted by November 20th).

4. Complete Bank Reconciliations

4.1

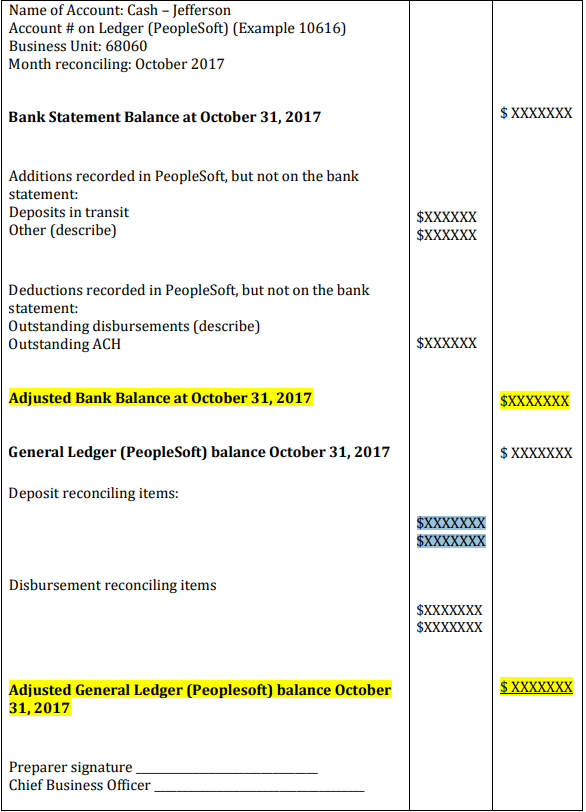

Bank reconciliations must be completed in the format prescribed by KCTCS Office of General Accounting Services (an example is at the end of this procedure).

- Any deviation from the prescribed format must have written approval from either the KCTCS Director of General Accounting Services.

4.2

For complete reconciliations, the college must send the following:

- Bank Reconciliation

- Bank Statement

- GL Activity Report

- Copy of entries made to PeopleSoft to correct prior months reconciling items (or indicate the journal ID on bank reconciliation)

- All should be sent electronically.

4.3

The general ledger must be adjusted for reconciling items the month following the reconciliation.

- Any amounts remaining outstanding on the reconciliation for a period of more than one month will be rectified via a journal entry prepared by KCTCS Office of General Accounting Services.

- The journal entry will adjust the college cash account using the account string 44300 01 706280 06038 00 and the college will be notified of the adjustment.

- The bank reconciliation and the entries to adjust for reconciling items that are sent to KCTCS Office of General Accounting Services must be reviewed and initialed by the college’s chief business officer as to correctness and accuracy.

- Bank reconciliations prepared by System Office of General Accounting Services are reviewed and initialed by the KCTCS Director of General Accounting Services.

5. Bank Reconciliation Responsibility

5.1

The college chief business officer has final responsibility for the bank reconciliation process.

5.2

Delegation of performing the actual reconciliation is permitted.

- Consideration must be given to ensure there is proper segregation of duties, (i.e. no one that makes actual deposits, or handles receivables, etc., is permitted to perform bank reconciliations).

- If lack of staff creates a problem with the segregation of duties, approval must be requested and granted in writing from KCTCS System Director of Treasury Management.

6. Instructions for Completing Bank Reconciliations

6.1

When determining the general ledger balance for a given cash account using PeopleSoft’s Financial Module, the query (or other reports used) must extract all information related to the cash account.

- The form at the end of this procedure, depicts cash account (10616) for Jefferson (BU 68060); but, transactions to account 10616 may have been coded to other college business units.

- It is critical that whatever reports or processes used to obtain general ledger balances from PeopleSoft’s Financial Module render the cash balance for the account in total.

- Activity for a given cash account can cross business units.

6.2

The bank reconciliation form is a two-part reconciliation.

- First, the reconciliation from the bank balance on the bank statement, to an adjusted bank balance.

- Second, the reconciliation from the general ledger (PeopleSoft) ending balance to an adjusted general ledger (PeopleSoft) balance.

- The PeopleSoft balance must be determined by including all transactions up to and including the end of the month date.

- To be considered reconciled, both the adjusted bank and general ledger (PeopleSoft) balances should equal each other.

6.3

Items that are adjustments to the bank (or top section) of the reconciliation are items that are already recorded in the general ledger (PeopleSoft) but did not appear on the bank statement for that month.

- Example - deposits recorded in the general ledger (PeopleSoft) at the end of the month that had not been deposited in the bank by the bank’s cutoff time for that day.

- This occurs when a deposit is taken to the bank at 3:30 PM on the last day of the month.

- Since the bank records transactions made after 2:00 pm on the next business day, that transaction is recorded by the bank on the first of the next month.

- The college recorded the deposit on the last day of the month; but it won’t appear on the bank statement until the following month.

6.4

Generally, any adjustments on the bank section of the reconciliation will not require any adjustments to the general ledger (PeopleSoft).

- Generally, these are only timing issues that should correct themselves the next month.

6.5

On the bottom section of the bank reconciliation (the general ledger/PeopleSoft), the starting point is the end of the month balance per the general ledger (PeopleSoft) balance.

- Below that, reconciling items are listed (items that either should have been recorded in the general ledger (PeopleSoft), but weren’t; or items that shouldn’t have been recorded in the general ledger (PeopleSoft), but were.

- There are two types of reconciling items, ‘Deposits’ or ‘Disbursements’.

- Examples of ‘Deposit’ type adjustments include a credit card deposit recorded in the general ledger (PeopleSoft) as a cash deposit; or, a deposit reflected on the bank statement that had not been recorded in the general ledger (PeopleSoft).

- Examples of ‘Disbursement’ type adjustments include a transfer that is reflected on the bank records, but was not recorded in the general ledger (PeopleSoft); or, a bank fee that needs to be recorded in the general ledger (PeopleSoft).

6.6

All reconciling items in the lower (general ledger/PeopleSoft) section of the bank reconciliation must have a corresponding journal entry attached to the bank reconciliation and entered in the next month to correct the error in order for the bank reconciliation process to be considered complete.

7. Bank Reconciliation Form Example