Administrative Procedures

Credit Card Clearing Account Reconciliation

Procedure Number: 5.3.15-P

Current Effective Date: 09/01/2017

Original Effective Date: 06/01/2012

Revision Dates: 06/01/2012, 09/01/2017

Revision Number: 2

Revision Summary:

Responsible Official: System Director of Treasury Management

References:

1. Purpose

To provide guidance on reconciling the credit card clearing account number 16035.

2. Scope

This procedure applies to all colleges and the System Office.

3. General

3.1

Each college and the System Office (SO) must complete a monthly reconciliation for each credit card clearing account.

- Reconciliations are due by the 20th day of the following month and should be emailed to so-accounting@kctcs.edu.

- The subject line of the e-mail should read: Business Unit, College, Account, Month-Year.

- For example, Big Sandy Community and Technical College would complete their May 2017 credit card reconciliation before June 20th and send it to soaccounting@kctcs.edu with the subject line “68100_BSCTC_16035_05-2017”.

3.2

The reconciliation contains three parts:

- Credit Card Activity Spreadsheet

- The Credit Card Activity Spreadsheet is derived from the SO central depository bank account and represents the “bank statement” for reconciliation purposes.

- General Ledger (GL) Activity Report

- The GL Activity Report is generated for account 16035 for the college BU for the month being reconciled.

- The ending balance for account 16035 will be the starting point of the credit card clearing account reconciliation.

- Since the GL activity report shows transaction totals, it may be helpful to query

the detail of the transactions. Recommended queries are as follows:

- K_SF_RCPTS_TENDER sorted by tender

- SF750A_CASHIER_TENDER_TOTALS

- AA_ALL_HRNL_LINES_BY_BU_ACCT

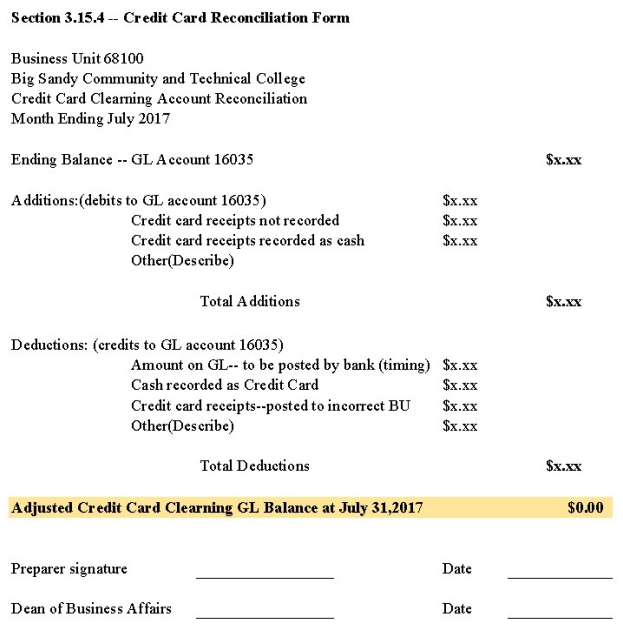

- Credit Card Reconciliation

- The credit card reconciliation is prepared by comparing the credit card activity spreadsheet to the GL activity report and listing the differences.

3.3

Differences are usually the result of timing issues where transactions were recorded in PeopleSoft but not by the bank or vice versa.

- Additions: Amounts that will debit (increase) GL account 16035 are credit card transactions

that should have been recorded but were not.

- For example, a credit card receipt that was initially recorded with a tender type of cash instead of credit card.

- Deductions: Amounts that will credit (decrease) GL account 16035 are credit card transactions

that have been recorded but should not have been.

- For example, a cash receipt that was recorded as a credit card receipt or a credit card receipt that was posted to the wrong business unit.

- In addition, transactions that took place at the end of the month and were not recorded by the bank, would be included here, as well.

3.4

The ending balance of the credit card clearing account reconciliation should be zero.

3.5

The Chief Business Officer of each college is responsible for ensuring the account 16035 reconciliation is completed accurately and in a timely manner.

- Delegation of performing the reconciliation is permitted; however, consideration should be given to ensure proper segregation of duties (i.e., employees who handle payments or receivables should not perform credit card reconciliations).

- If a lack of staff creates a segregation of duties concern, a plan for mitigating the risk exposure should be submitted to and approved by the KCTCS System Office Director of Treasury Management.